Increasing health problems due to regular consumption of sugar, and rising consumer awareness, and preference for low-calorie foods have resulted in the growth of the sugar substitutes market. Increasing demand for sugar substitutes in a wide range of beverage, food, and health & personal care applications are driving the sugar substitutes market. Increased research & development activities by key players form another driving factor for this market.

Sugar substitutes are used by several food & beverage manufacturers to replace regular sugar and tweak the sweetness intensity of their final products. Modern consumers are more health-conscious and aware of health issues associated with consumption of high caloric regular sugar, and hence prefer healthy products containing low caloric sweeteners. Sugar substitutes can be graded on the basis of source, sweetness intensity, base component, calories, taste, and texture imparted to the final product. Based on the amount of calories that the sugar substitutes impart upon consumption, they are classified as caloric and non-/low-caloric sugar substitutes. Non-caloric sweeteners, depending upon the relative potency of sweetness to sucrose, are further classified as high-intensity sweeteners (HIS) and low-intensity sweeteners (LIS).

The primary factor driving the sugar substitutes market is the rise in the increasing demand for low-calorie products and growing awareness of the benefits of sugar substitutes. Sugar substitutes are widely used in processed foods, including baked goods, soft drinks, powdered drink mixes, candy, puddings, canned foods, jams and jellies, dairy products, ice creams and beverages.

The worldwide demand for sugar substitutes is on the rise, particularly in the beverages industry. The demand is governed by their performance quality, sweetness intensity, quantity incorporation in food & beverages processing, and regulations imposed by international and local governments.

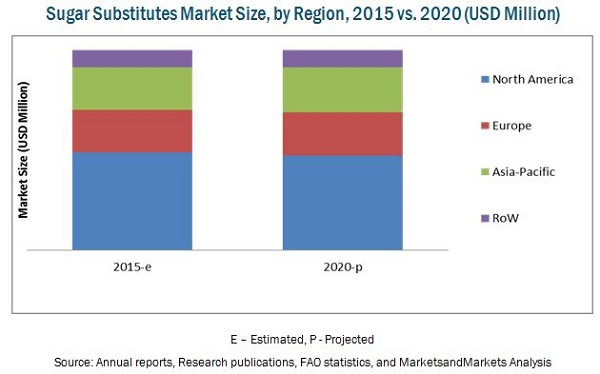

The sugar substitutes market is estimated to be valued at USD 13.26 Billion in 2015 and is projected to reach USD 16.53 Billion by 2020, at a CAGR of 4.5%. In terms of volume, the market is projected to reach 17.03 million tons by 2020, at a CAGR of 1.0% from 2015. The Asia-Pacific market is projected to grow at a CAGR of 5.5% in terms of value during the review period, due to the increase in demand for low-caloric products in developing countries such as China, India, Vietnam, Thailand, and Japan.

North America accounted for the largest share of ~50% of the global sugar substitutes market in 2014. The market here is projected to grow significantly at a CAGR of 3.8% in terms of value and 0.5% in terms of volume, from 2015 to 2020. The U.S. accounted for the largest country-level market share in 2014, followed by Japan. The U.S. and Japan were the two major sugar substitutes consumers in 2014, and are projected to grow at CAGRs of 0.3% and 1.9%, respectively, in terms of volume, from 2015 to 2020.

The high-intensity sweeteners segment accounted for the largest market share of ~60% of the global sugar substitutes market in 2014 in terms of value. The low-intensity sweeteners segment is projected to grow significantly at the highest CAGR of 6.1%, from 2015 to 2020.

The sugar substitutes market exhibits variations due to the different range of products offered by different companies; the overall market is dominated by several players, both regional as well as international. Key players identified include Cargill, Incorporated (U.S.) and Tate & Lyle PLC (U.K.), collectively accounting for more than 33% of the total sugar substitutes market in 2014. Other players, which include PureCircle Ltd. (Malaysia), Roquette Freres S.A. (France), MacAndrews & Forbes Incorporated (U.S.), Ingredion Incorporation (U.S.), JK Sucralose Incorporation (China), Ajinomoto Co. Inc. (Japan), Archer Daniels Midland Company (U.S.) and E.I. DuPont de Nemours and Company (U.S.), also have a strong presence in the global sugar substitutes market. Tate & Lyle PLC (U.K.) and JK Sucralose Incorporation (China) are the global leaders in the sucralose segment. Purecircle Ltd. (Malaysia) dominates the stevia segment. Cargill, Incorporated (U.S.) and Roquette Freres S.A. (France) are dominant in the sugar polyols market segment.