The ADAS market is projected to grow from 359.8 million units in 2025 to 652.5 million units by 2032 at a CAGR of 8.9%. Advancements in low-cost, high-resolution sensors—such as cameras, radar, and ultrasound—combined with AI-driven algorithms, are significantly enhancing object detection and predictive safety features in ADAS. Camera technology, in particular, has benefited from high-resolution imagers originally developed for smartphones, leading to improved detection accuracy and better performance in low-light conditions. LiDAR systems are becoming more affordable and compact, allowing their integration into a wider range of vehicle models for precise 3D mapping and obstacle detection. At the same time, radar sensors are evolving to offer improved range resolution and better clutter rejection, which enhances their effectiveness in poor weather where optical sensors may be less reliable.

Some of the major players in the ADAS market with significant global presence include Robert Bosch GmbH (Germany), Continental AG (Germany), Denso Corporation (Japan), ZF Friedrichshafen AG (Germany), and Magna International Inc. (Canada). These players have incorporated various organic and inorganic growth strategies, including collaborations, acquisitions, partnerships, agreements, and expansions, to strengthen their international footprint and capture a greater share in the ADAS market. These organic and inorganic strategies have allowed the market players to expand across geographies by offering ADAS.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1201

Robert Bosch GmbH focuses on delivering comprehensive and integrated driver assistance systems by leveraging its deep expertise in automotive electronics, sensor technology, and system integration. The company continuously invests in developing advanced sensors, such as long-range LiDAR and multi-axis inertial sensors, to enhance environmental perception and driving safety. It offers a wide range of ADAS features—including adaptive cruise control, predictive emergency braking, and multi-camera systems—targeting various vehicle segments. Bosch emphasizes sensor fusion to improve data reliability and precision, thereby supporting higher levels of automation. Its approach combines hardware innovation with software capabilities to meet the growing demands of aided and autonomous driving.

Continental AG plans to deliver cutting-edge safety, comfort, and automation technologies through its newly rebranded Automotive Group, Aumovio. The company emphasizes integrated sensor systems, braking technologies, and human-machine interfaces to enable safe and connected driving experiences. With a strong portfolio of ADAS solutions like adaptive cruise control, lane departure warning, and parking assistance, Continental enhances vehicle safety and performance. Aumovio aims to lead in software-defined vehicle architectures by combining hardware innovation with advanced software platforms. The spin-off enables a sharper focus on autonomous mobility and strengthens its position in the evolving ADAS ecosystem.

ZF Friedrichshafen AG integrates advanced sensor technologies, electronics, and intelligent systems to enhance safety, automation, and driving efficiency. Through its Electronics and ADAS Division, ZF develops comprehensive driver assistance solutions, leveraging its expertise in chassis, steering, and braking systems for seamless integration. The company emphasizes scalable, software-driven ADAS platforms to support increasingly automated driving functions. ZF also focuses on combining electrification and digitalization to deliver end-to-end solutions tailored for both passenger and commercial vehicles. This holistic approach positions ZF as a key enabler in the evolution toward safe and autonomous mobility.

Denso Corporation focuses on advancing sensors and control technologies through its Mobility Electronic Systems segment, which develops key components such as advanced driver assistance systems, sensors, and integrated electronic control units. A key part of this strategy is the establishment of DENSO ADAS Engineering Services (DNAE) in Germany, aimed at accelerating the development of camera-based algorithms essential for autonomous driving. By integrating ADAS innovation into its broader electrification and mobility electronics initiatives, and leveraging global collaboration within its Global Safety Group, Denso is positioning itself as a critical enabler of future mobility with an emphasis on safety, sensing precision, and embedded system integration.

Magna International Inc. leverages its Electronics Systems portfolio to deliver a comprehensive range of advanced driver assistance solutions. These include technologies for collision avoidance, adaptive cruise control, driver monitoring, parking assistance, trailer support, and advanced viewing systems. Integrated within the Power & Vision segment, Magna’s ADAS offerings are designed to enhance vehicle safety, performance, and driver comfort. By combining its strengths in electronics, mechatronics, and system integration with its broader capabilities in complete vehicle engineering and manufacturing, Magna positions itself as a key partner to OEMs, aiming to support the transition toward safer and more automated mobility.

Market Ranking

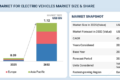

The ADAS market is competitive, with five leading players such as Robert Bosch GmbH (Germany), Continental AG (Germany), Denso Corporation (Japan), ZF Friedrichshafen AG (Germany), and Magna International Inc. (Canada) collectively holding 21-31% of the total market share. Bosch focuses on sensor fusion, advanced camera technologies, and integrated electronic systems to enable scalable, high-precision ADAS solutions for assisted and automated driving. ZF leverages its strengths in chassis, steering, and electronic systems to deliver modular, software-defined ADAS platforms that support electrified and autonomous mobility. Continental (Aumovio) drives innovation in ADAS through smart sensor systems, connected vehicle technologies, and software platforms to enhance safety, comfort, and autonomous driving capabilities. Denso develops sensors and ECUs, leveraging dedicated R&D like DNAE to drive camera-based ADAS innovation for safer and autonomous mobility. Magna delivers integrated ADAS solutions like collision avoidance and parking assistance. It uses its strength in electronics, vision, and vehicle engineering to support safer and smarter mobility. The remaining 69-79% of the market is shared among other regional and emerging players, contributing to competition and offering opportunities for smaller players to establish a footprint. Market competition in the ADAS market is driven by technological innovation, product integration capabilities, software expertise, cost-effectiveness, regulatory compliance, and strategic partnerships with OEMs.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=1201