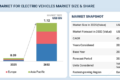

The automotive usage-based insurance industry has evolved along with the automotive industry. The demand for usage-based insurance market is largely influenced by increasing vehicle sales with telematics and connected car services, reduction in insurance as compared to the traditional insurance, and increasing vehicle sales and parc. The global usage-based insurance market for automotive was valued to be USD 21.86 billion in 2017 and is projected to reach USD 95.81 billion by 2025, at a CAGR of 18.95%, during the forecast period.

Download FREE PDF Sample Report at: https://www.marketsandmarkets.com/requestsample.asp?id=154621760

Increasing vehicle with telematics and connected car services to drive the global usage-based insurance for automotive demand close to USD 96 billion by 2025

The usage-based insurance for automotive is a method to calculate the insurance premium. The amount of insurance premium is decided on the basis of a driving score which is calculated by considering factors such as vehicle usage, location, speeding, braking, cornering, night driving, and distracted driving. Based on the driving score, automotive insurance providers offer a discount on the insurance premium.

Ambiguity over regulations and legislative environments are acting as a restraint for the usage-based insurance market as usage-based insurance providers need to plan new product for different states with in a country.

Furthermore, ongoing new product developments and partnerships by leading companies are likely to propel the growth of usage-based insurance in the untapped markets for the long forecast.

Market Dynamics

Drivers

- Increasing adoption of telematics and connected cars

- Reduction in insurance premium and risk-related costs

- Increasing vehicle sales and parc

Opportunities

- Automotive usage-based insurance ecosystem

The usage-based insurance market consists of companies such as Progressive Corporation (US), Vodafone (UK), Allstate (US), Octo Telematics (UK), TomTom (Netherlands), Allianz (Germany), AXA (France), Liberty Mutual (US), Verizon (US), and Sierra Wireless (Canada).

Manage-How-You-Drive (MHYD) is expected to be the fastest growing market for usage-based insurance by package type owing to increasing sales of vehicles equipped with telematics unit and connected car services which make it cost-effective to adopt MHYD without any external hardware. Pay-As-You-Drive (PAYD) is estimated to be the largest market during the forecast period owing to reasons such as ease of deployment, no complex algorithms for working, and cost-effectiveness for the insurer as well as consumers.