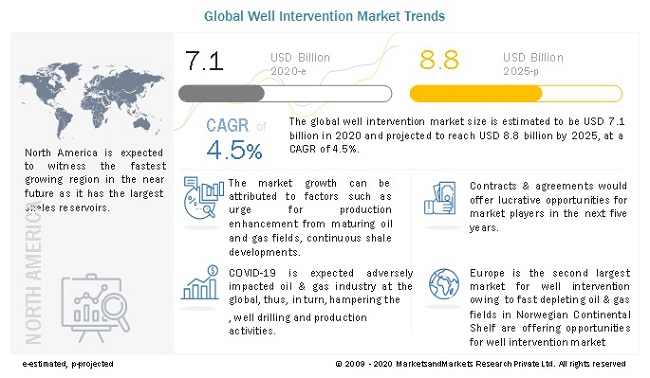

The global intervention market is projected to reach USD 8.8 billion by 2025 from an estimated USD 7.1 billion in 2020, at a post COVID-19 CAGR of 4.5 % during the forecast period. Stabilized oil prices have revitalized the exploration & production expenditures globally. This has led to increased investments in the enhancement of productivity of oil & gas wells. Furthermore, the global well intervention market is driven by the upsurge in the oil & gas production by countries owing to rising demand from the Asia Pacific.

The well intervention market has promising growth potential due to the continuous shale developments. It is difficult to extract oil & gas from shale reservoirs due to which shale reservoirs require more intervention processes to optimize oil production. According to the IEA, the shale production from the US alone is expected to cross 100 million barrels per day. Shale development in other countries such as China and Argentina are also likely to boost the well production activities in these countries, which is likely to drive the well intervention market in North America, Latin America, and Asia Pacific.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1099

The well intervention market, by service type, is segmented into logging & bottomhole survey, tubing & packer failure, stimulation, remedial cementing, zonal isolation, sand control, artificial lift, fishing, and reperforation. Sand control services are observed to be new revenue pockets for the oil field service providers owing to the drilling of shale reservoirs and oil sand formations. The services help in reducing the operational expenditure that is involved with the removal of sand. The need to enhance production from mature reservoirs are expected to drive the market for this segment during the forecast period.

The report segments the well intervention market, by well type, into horizontal and vertical. The horizontal segment of the well intervention market is expected to grow at the highest CAGR during the forecast period, as horizontal drilling is observed as a more efficient method of drilling. The horizontal wells account for about 70% of the total drilled wells. Furthermore, the offshore and shale developments have boosted the horizontal well type to be the largest and the fastest growing segment of the global well intervention market.

Ask for Sample Pages of the Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=1099

The well intervention market, by application, is categorized into onshore and offshore. The African offshore segment is expected to provide many opportunities for well intervention market in the future, owing to huge drilling activities in offshore Angola, and Mozambique gas production activities. The offshore segment is further segmented based on the well depth as shallow, deepwater, and ultra-deepwater. The ultra-deepwater segment is expected to be the promising segment for well intervention providers. Growth is driven majorly by the increasing ultra-deepwater drilling and production activities and an increase in the number of maturing subsea wells. Furthermore, the investments to revive the mature onshore fields are expected to offer lucrative opportunities for the well intervention manufacturers during the forecast period.

Key Market Players

The major players in the global well intervention market are Halliburton (US), Schlumberger (US), Baker Hughes Company (US), Weatherford (Switzerland), NexTier Oilfield Solutions(US), NOV (US), Superior Energy Services(US), Archer (Norway), Altus Intervention (Norway), and Expro Group (UK).

North America is estimated to be the fastest growing market for well intervention during the forecast period. The region has been segmented, by country, into US and Canada. The increasing shale oil & gas production in the North America region is driving the well intervention market in this region. According to the BP statistical report for June 2019, the US is the top producer of oil, producing 15.3 billion barrels of oil, in 2018. Moreover, the country has been experiencing huge investments from upstream operators to increase the production from the depleting fields in Texas, Permian Basin, and the Gulf of Mexico, along with new drilling activities in ultra-deepwater locations in the Gulf of Mexico, which is likely to drive the North American well intervention market.