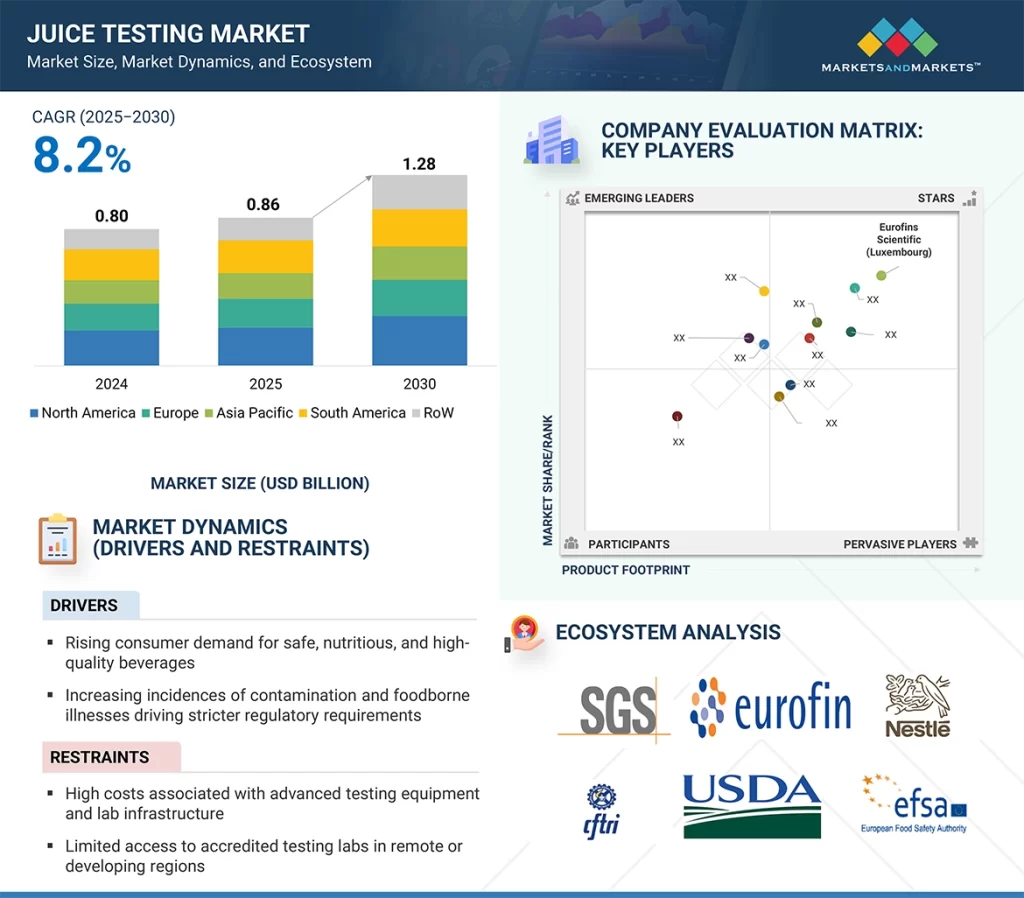

The global juice testing market is projected to grow from USD 0.86 billion in 2025 to USD 1.28 billion by 2030, registering a CAGR of 8.2% over the forecast period. This growth is being driven by increasing consumer awareness around health, wellness, and food safety, along with rising demand from manufacturers seeking to comply with strict quality and regulatory standards. The market is further fueled by the growing incidence of contamination, food fraud, and allergen-related recalls, which underscore the need for advanced testing solutions. Additionally, the rise in global juice production—particularly across emerging economies—combined with tighter international trade regulations, is prompting companies to adopt reliable testing practices that ensure product safety, quality, and global marketability.

By Test Type: Chemical Testing Dominates

Chemical testing accounts for a significant share of the juice testing market due to its critical role in validating product composition, ensuring safety, and meeting regulatory compliance. Manufacturers routinely use chemical analyses—such as measuring acidity, preservative levels, and screening for contaminants—to maintain product consistency, prevent spoilage, and adhere to labeling requirements. Increasingly stringent food safety regulations have boosted demand for advanced chemical testing technologies, including chromatography and spectrometry, which enable accurate detection of pesticides, heavy metals, and artificial additives. Additionally, the growing consumer preference for clean-label and functional juices has spurred further investment in additive monitoring. Technological advancements that improve efficiency and lower testing costs continue to drive growth in this segment, solidifying chemical testing as an essential component for juice manufacturers focused on quality assurance and brand differentiation.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=261087115

By Product Type: Mixed Juices Lead the Market

Mixed juices represent a significant portion of the juice testing market, supported by their growing appeal among health-conscious consumers seeking diverse nutritional benefits from fruit and vegetable blends. The complexity of mixed juice formulations demands rigorous testing to verify product safety, ensure accurate labeling, and maintain shelf-life stability. Market growth is further bolstered by consumer interest in innovative flavor profiles and functional beverages, particularly in urban markets. As demand for clean-label and organic options continues to rise, manufacturers are prioritizing comprehensive quality assurance, driving increased reliance on advanced testing methods. Looking ahead, innovations such as rapid testing technologies, AI-powered quality analysis, and customized protocols for plant-based nutrient blends present new opportunities. Additionally, tighter export regulations are expected to further encourage investments in testing, solidifying mixed juices’ role in driving the global juice testing market.

By Region: Asia Pacific Emerges as Fastest-Growing Market

Asia Pacific is forecasted to be the fastest-growing region in the juice testing market, propelled by rising health awareness, expanding urban populations, and increasing demand for packaged beverages. Rapid industrialization and heightened regulatory scrutiny on food safety are encouraging manufacturers to implement rigorous quality control measures. Major markets—including China, India, Japan, and South Korea—are experiencing strong growth in both domestic consumption and exports of juice products, driving demand for robust testing protocols. The region also benefits from the emergence of new testing laboratories, ongoing technological advancements, and supportive government initiatives aimed at strengthening food safety standards. As consumer demand for high-quality, safe juice products continues to rise, Asia Pacific is poised for sustained growth in juice testing solutions.

Leading Juice Testing Companies

Leading players profiled in the market include:

- Eurofins Scientific (Luxembourg)

- SGS Société Générale de Surveillance SA (Switzerland)

- ALS (Australia)

- Intertek Group plc (UK)

- Mérieux NutriSciences Corporation (France)

- Certified Group (US)

- TÜV SÜD (Germany)

- Symbio Labs (Australia)

- Alfa Chemistry (US)

- FoodChain ID (US)

- AGQ Labs (Spain)

- Tentamus (Germany)