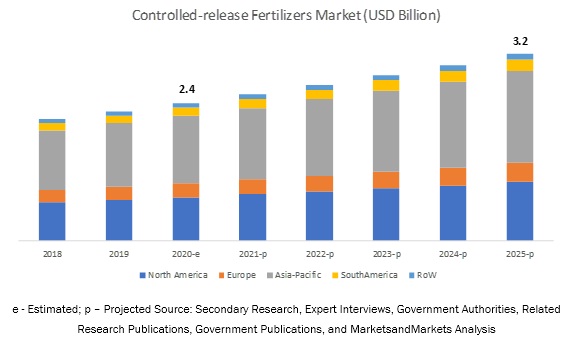

The global controlled-release fertilizers market is estimated at USD 2.4 billion in 2020 and is projected to reach USD 3.2 billion by 2025. The market is projected to grow at a rate of 6.3% during the forecast period. Factors driving the market include an increase in demand for highly efficient fertilizers, favorable government regulations, a rise in demand for high-value crops, and an increase in the number of investments from key players in this market. The growing environmental concerns associated with nutrient loss through soil leaching and runoffs from fields on the using excess conventional fertilizers are effectively addressed by these fertilizers.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

The fertigation segment of controlled-release fertilizers is projected to account for the largest market share, by mode of application

The controlled-release fertilizers market, by application method, was dominated by the fertigation segment. Fertigation is a technique that has been adopted by major countries. In this technique, the fertilizer is included with irrigation water and applied through systems. This technique witnesses better application than broadcasting and subsurface placement. Owing to the increasing irrigated land, fertigation is highly preferred as a suitable application method adopted in both developed and developing countries across the globe for the application of these fertilizers. Also, the labor costs are reduced to a large extent through the adoption of these techniques, which also adds to their increasing demand.

The N-stabilizers segment is projected to account for the largest market share, by type

In terms of volume, the N-stabilizers segment is projected to account for the largest market share during the forecast period. The Asia Pacific accounted for the largest share of the N-stabilizers fertilizers market in 2020, owing to its vast adoption across the globe for agricultural crops and its viable purchasing price. Another factor could be the extensive use of nitrification inhibitors and Urease Inhibitors for non-agricultural usage in developed countries. In terms of value, the coated & encapsulated segment is projected to be the fastest-growing, during the forecast period, and slow-release in terms of value.

The Asia Pacific region is projected to account for the largest market share during the forecast period.

Asia Pacific dominates the market, with 49% of the global market share. The government policies adopted by Asia Pacific countries and large subsidies, in certain countries up to 100% for marginal farmers, provided on fertilizers are the major factors triggering the growth of this market in the region. R&D investments in the development of coated fertilizers and the installation of new production capacities by key players are also expected to boost the market in the next five years.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=136099624

This report includes a study of marketing and development strategies along with the product portfolios of leading companies in the controlled-release fertilizers market. It includes the profiles of leading companies such as Nutrien Ltd. (Canada), Yara International ASA (Norway), ICL (Israel), ScottsMiracle-Gro (US), Koch Industries (US), Helena Chemical (US), Kingenta (China), SQM (Chile), Haifa Chemicals (Israel), JCAM AGRI. (Japan), COMPO EXPERT (Germany), Nufarm Ltd. (Australia), The Andersons Inc. (US), Van Iperen International (Netherlands), Mosaic Company (US), OCI Nitrogen (Netherlands), AgroLiquid (US), DeltaChem (Germany), SK Specialties (Malaysia), and Pursell Agri-Tech (US). New product launches, expansions, agreements, and acquisitions have been the areas of focus of these manufacturers to gain better penetration in the developing markets of Asia Pacific and South America.

Recent Developments:

In September 2019, Nutrien, Ltd. (Canada) acquired Ruralco Holdings Limited (Ruralco) in Australia. Through this acquisition, Nutrien would provide significant benefits to its stakeholders as well as enhance the delivery of its products and services to Australian farmers.

In August 2019, Yara International ASA (Norway) and Nel Hydrogen Electrolyser, a division of Nel ASA (Norway), entered into a collaboration agreement for low-carbon-footprint fertilizer production at Yara’s existing plant in Porsgrunn, Norway. This project was supported by the Research Council of Norway, Innovation Norway, and Enova through the PILOT-E program.

In March 2019, Yara International ASA (Norway) launched Yaralix, a tool for precision farming, allowing the farmers to measure crop nitrogen requirements using their smartphones. The system consisted of a free-to-download application that was designed to handle the smartphone camera to determine nitrogen requirements for different crops in the early growth stages.