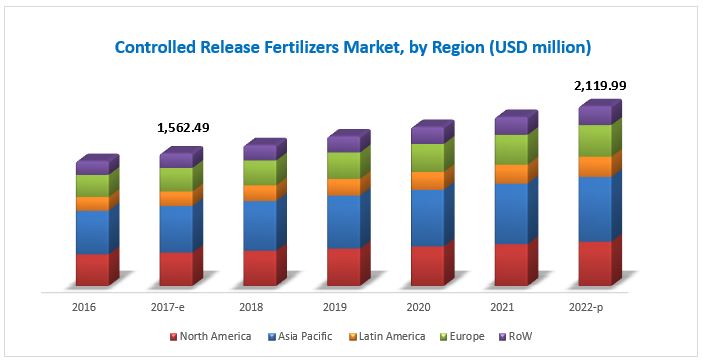

The controlled-release fertilizers market is projected to grow at a CAGR of 6.29% from USD 1.56 Billion in 2017, to reach USD 2.12 Billion by 2022. Due to the increasing demand for high efficiency fertilizers to minimize nutrient losses, controlled-release fertilizers have been gaining preference for their beneficial characteristics such as patterned nutrient release and their effect on the agricultural yield.

Favorable government policies and regulations

Government policies and regulations have always been one of the key factors at propelling and promoting the production of a particular commodity or system.

Labeling and manufacturing guidelines for controlled-release fertilizers, which serve as a mark of a superior standard or trust, have been mandatorily adopted and regulated in many nations, especially the US and also the European countries. These products are promoted by domestic fertilizer regulatory agencies in accordance with the view of the government policy frameworks to minimize the environmental hazards caused by leaching and nutrient loss. For instance, China’s guiding catalog of Industrial Infrastructure Adjustment (2011 edition) classified CRF as one of the encouraged items, indicating the development of CRF to speed up during China’s 11th five-year plan, from 2011-2015. After the proposal of China’s 11th five-year plan, the growth of CRF in the country spiked up by 30% during the last 15 years. Such government policies and well-defined regulations act as a boosting factor for the growth of this market at the global level.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

Improper management of controlled-release fertilizers

The application costs of controlled-release fertilizers are comparatively low due to the less labor requirements and reduced application cycles. However, training and management of controlled-release fertilizers are a pre-requisite for the adoption of the technology. Improper application methods and storage techniques can deteriorate the results expected from these fertilizers. Furthermore, there is unawareness about the brands in the market as the market is highly fragmented at the regional level. Despite the considerable efforts by agronomists across the globe in recent years, a majority of farmers do not prefer controlled-release fertilizers.

The mixing rate of fertilizers for fertigation or broadcasting application is of prime importance to ensure proper diffusion of the nutrients into the soil and avoid nutrient leaching. On the contrary, management of conventional fertilizers requires minimal conditions and hence, farmers show high preference in using conventional fertilizers. Appropriate training/knowledge to the farmers on controlled-release technology and management of these fertilizers have to be provided so that they can fully utilize their benefits to increase crop productivity. Regulated labeling of controlled-release fertilizers such as in the US, emphasizing on the directions of use, and hazards associated with improper management have to be encouraged across the globe. Also, awareness campaigns by governments in developing countries along with training programs on the management of controlled-release fertilizers from manufacturers would subsequently encourage more farmers to adopt this technology.

Request for Customization: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

Significant competition to capitalize the market potential among international manufacturers in the Asia Pacific and South American regions

Rise in export quality requirements for agricultural products and increasing adoption of sustainable agriculture practices in countries such as China, India, Brazil, and Argentina are expected to drive the demand for controlled-release fertilizers among the farmers in the Asia Pacific and South American regions during the forecast period. This would increase the inflow of various international manufacturers to set up their business units and distribution networks, thereby leading to a strong market competition.

This report includes a study of marketing and development strategies, along with the product portfolio of leading companies. These companies include Agrium (Canada), Yara (Norway), ICL (Israel), Kingenta (China), and Helena Chemical (US), which are some of the well-established and financially stable players that have been operating in the industry for several years. Other players include ScottsMiracle-Gro (US), SQM (Chile), Haifa Chemicals (Israel), Koch Industries (US), AGLUKON (Germany), COMPO EXPERT (Germany), and JCAM AGRI (Japan).