The growth of the global switchgear market is driven by rising electricity demand due to urbanization and industrial expansion, pushing utilities and industries to upgrade and expand their power infrastructure. The rapid development of renewable energy sources like solar and wind is also necessitating advanced switchgear systems for efficient grid integration.

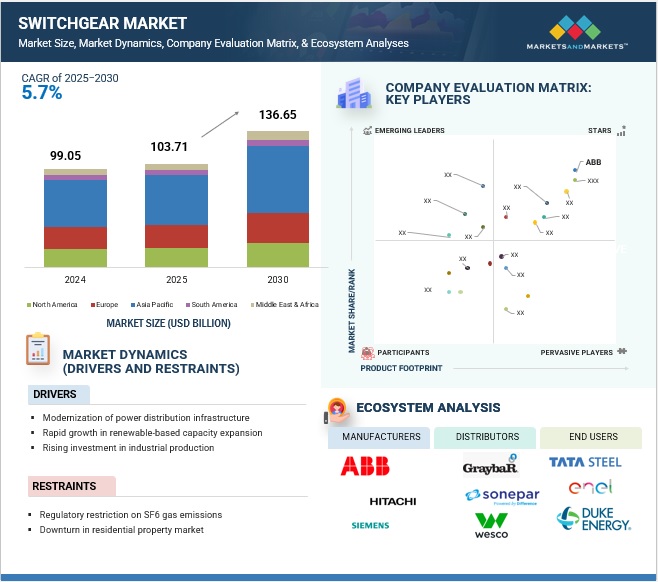

The global switchgear industry is estimated to be valued at USD 103.71 billion in 2025 and is projected to reach USD 136.65 billion by 2030, growing at a CAGR of 5.7 % during the forecast period of 2025–2030.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1162268

One of the most transformative advancements reshaping the switchgear industry is development and adoption of SF6-free technologies, driven by stringent environmental regulations targeting greenhouse gas emissions. SF6, a potent greenhouse gas traditionally used in gas-insulated switchgear, is being phased out in favor of eco-efficient alternatives like vacuum and air insulation technologies. Additionally, the integration of digital switchgear featuring IoT sensors, real-time monitoring, and predictive maintenance capabilities is revolutionizing asset management and operational efficiency. Regulatory mandates promoting smart grid deployment and renewable energy integration are further accelerating the shift toward intelligent, sustainable switchgear solutions, fundamentally altering the competitive landscape and driving innovation across the industry.

In North America, the air-insulated switchgear (AIS), by insulation segment, holds the largest market size, primarily due to the region’s extensive network of aging substations and transmission infrastructure, which requires cost-effective upgrades. AIS is favored in North America for its lower initial investment and simpler maintenance than gas-insulated systems, especially in rural and suburban areas with minimal space constraints. Additionally, many utilities and industrial facilities in the US and Canada continue to prefer AIS for medium-voltage applications, supported by established installation standards and a strong domestic manufacturing base. The growing emphasis on grid resilience, combined with investments in renewable integration and rural electrification, further boosts AIS demand across the region.

The outdoor switchgear segment, by installation, is the fastest-growing installation type in North America due to the rising demand for expanding and modernizing transmission and distribution networks to support renewable energy integration and rural electrification. Also, countries in North America are increasingly investing in grid infrastructure upgrades, particularly in remote and semi-urban regions where outdoor switchgear is more suitable and cost-effective compared to indoor alternatives. Outdoor switchgear is ideal for high-voltage applications and large substations, which are critical for integrating wind and solar farms that are typically located away from urban centers. Furthermore, resilience initiatives to protect infrastructure against extreme weather events—such as storms and wildfires—are driving the deployment of durable, weather-resistant outdoor switchgear across the region.

Market players in the switchgear industry are actively tapping into emerging opportunities by aligning their strategies with key industry trends such as digitalization, sustainability, grid modernization, and the rapid expansion of renewable energy. Companies like Siemens (Germany), ABB (Switzerland), Schneider Electric (France), Hitachi, Ltd. (Japan) and Eaton (Ireland) are investing heavily in smart and digital switchgear solutions that integrate IoT, AI-based monitoring, and predictive maintenance, helping utilities and industries improve energy efficiency and operational reliability. They’re also expanding their product portfolios to include SF6-free and eco-efficient switchgear in response to stringent environmental regulations, particularly in Europe and North America. Leading players are forming strategic partnerships and joint ventures with local utilities and EPC contractors in fast-developing markets like India, Southeast Asia, and parts of Africa. This helps them address localization requirements while accelerating project delivery. Moreover, companies are setting up regional manufacturing units and R&D centers to reduce costs and increase responsiveness to local demand. The growth in data centers, EV charging infrastructure, and industrial automation has also encouraged players to develop modular, compact, and high-reliability switchgear suited to modern infrastructure needs. Additionally, mergers and acquisitions are being used as a tool to enter niche markets or acquire specific technologies—such as DC switchgear or digital substation solutions—ensuring a competitive edge in a rapidly evolving market landscape.

Make an Inquiry – https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=1162268

In North America, the US dominates the switchgear industry during the forecasted period due to significant growth, driven by its large-scale investments in grid modernization, renewable energy integration, and infrastructure upgrades. The country’s push toward decarbonization and electrification is accelerating the adoption of advanced switchgear technologies, including digital and eco-efficient systems. Supportive government policies, such as incentives for clean energy projects and smart grid development, are further propelling market expansion. The Transmission and Distribution, by end user segment, holds the largest market size in the US switchgear market due to the country’s vast and aging power infrastructure, which requires continuous upgrades, replacements, and modernization to meet growing electricity demand and integrate renewable energy sources. Utilities are investing heavily in replacing outdated substations and equipment with advanced, more reliable switchgear systems to enhance grid resilience and reduce outage risks. Additionally, the push toward decarbonization and clean energy goals—such as integrating large-scale solar and wind power—necessitates expanding and strengthening the T&D network. Government-backed initiatives and funding programs, including those from the US Department of Energy and state-level clean energy mandates, further accelerate switchgear deployment across utility-scale projects, solidifying T&D as the dominant end-user segment in the US market.